The OBR has today released a scenario on the potential impacts of the coronavirus on the UK economy. The measures announced by the UK Government to help support businesses and individuals through the pandemic outbreak equate to not just policy changes but a significant fiscal package, and an increase in public borrowing has been required to make it happen.

This OBR report is focused on the short-term impacts of the crisis, but the medium-term consequences will be important too. We can expect for now, major deviations from previous budgets and forecasts. Although, we should exercise caution with first look forecasts and assumptions which are very likely to change as the situation continues to unfold.

Government measures taken now to support in the long-run

The Government know that the measures they take now are required to help limit the long-term economy damage to the economy. The OBR is also very clear that measures taken now, although expensive from a borrowing perspective, will cost less in the long run than the impact of no action to support the economy being taken.

Whilst it is difficult to predict how long the effects of COVID-19 will last, the OBR has made some assumptions linked to the Government lockdown and public health guidance. Assuming a three-month UK lockdown there is a significant 35% decline in real GDP in Q2 as a result of economic inactivity, rises in unemployment, and a general shock to household income, companies finances and overall confidence.

Scenario impacts on borrowing and output

Public sector debt levels will rise in the short term, with borrowing levels assumed 9% higher than at 2020 budget, mixed with lower receipts – 15% higher than at March 2020 budget – and overall lower GDP. Public sector net borrowing in this OBR scenario is assumed to reach £273bn in 2020-21 or 14% of GDP.

Similarly, the lack of output of the UK economy in this OBR scenario assumes an impact felt in Q2 relative to a pre-crisis baseline. For manufacturing, output is assumed to fall a potential 55%, but is not the hardest hit sector.

Growth in Q3 and Q4 but scenario assumes double digit 2020 annual decline

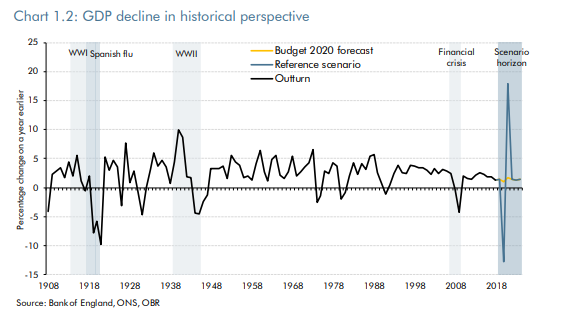

The OBR have assumed that GDP regains its pre-virus level by the fourth quarter, with GDP growing significantly in Q3 and again in Q4 by 25% and 20% respectively. The overall assumed impact on GDP equates to a 13% fall in annual figures for 2020 compared to 2019. This is a more significant annual decline to the UK economy than each world war and more than in the financial crisis.

ADS continue to engage closely with Government identifying policies that will help support a strong long-term recovery for our sectors. Protecting investment, jobs and ensuring companies survive this difficult economic time remains a key priority for all.