ADS member confidence remains robust in Q3 with growth opportunities sought in exports

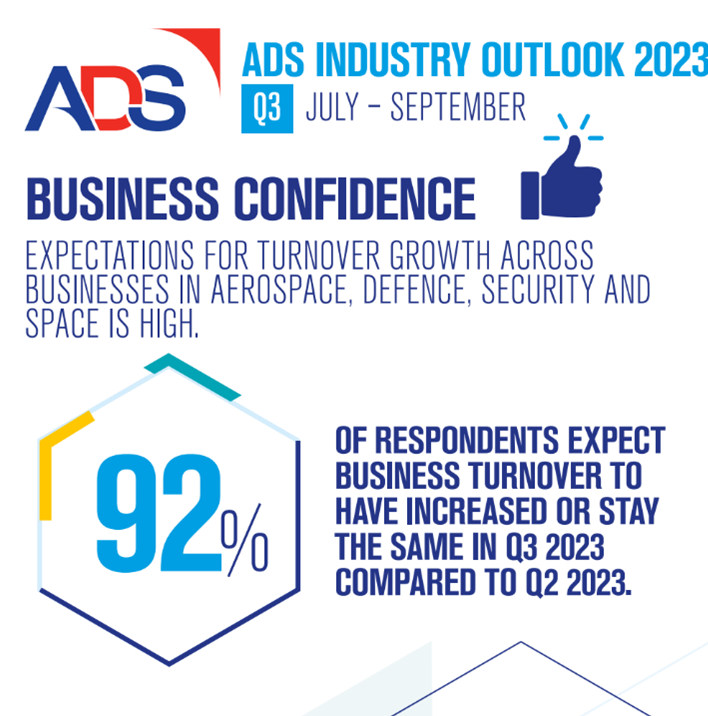

The regular Industry Outlook survey to ADS members has returned a clear message that the outlook for the third quarter of 2023 remained robust in our sectors. Notably, 92% of respondents expect business turnover to increase or stay the same in Q3 2023.

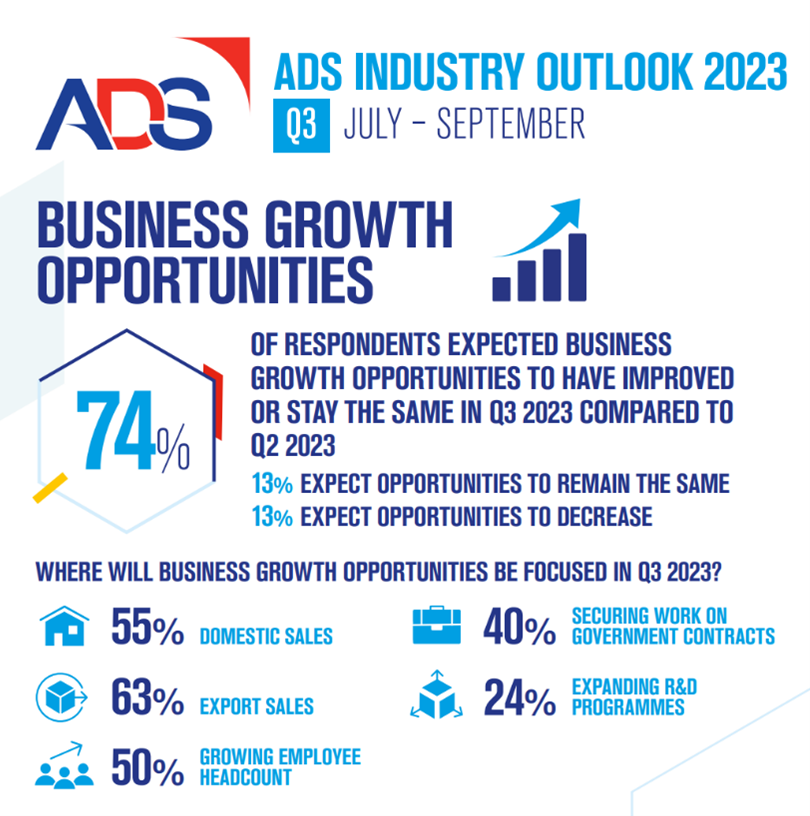

In line with the previous two quarterly surveys, ADS asked our members on their outlook and intentions, this time for Q3 2023. Similar to expectations on business turnover, the overwhelming majority of respondents (86%) expected business investment to stay the same or increase throughout Q3 2023. Similarly, 74% expect business growth opportunities to have increased in the third quarter. This can partially be attributed to the ongoing aerospace recovery which will be discussed later in this article.

It is encouraging to see this consistent confidence from ADS members when the background economic conditions continue to pose obvious challenges to all of industry. UK GDP expanded by 0.2% in August, following July’s downwardly revised 0.6% contraction. Since February, UK GDP growth has been flip-flopping between growth and contraction, and inflation is behaving slightly unpredictably.

Other data supporting this underlying confidence trend for the aerospace sector is the 2,188 aircraft orders placed year to date, at the end of Q3 2023, constituting a 57% increase year to date with single-aisle aircraft the most popular aircraft, accounting for almost 80% of orders so far this year.

Throughout the year announcements have been publicly made by manufacturers intending to ramp up rate throughout 2023 and into 2025. However, reported supply challenges have meant that deliveries haven’t increased at the expected pace, which has tempered the expectations of the growth rate for some ADS members.

The backlog of aircraft orders represents a significant opportunity for the UK aerospace sector at the end of September, as it reached another all-time high at 14,690, with 10% growth on Q3 2022. It is worth remembering that aircraft on backlog order are estimated to be worth a potential £229bn to the UK and more than ten years’ worth of work at current rates! However, this is just one part of the sectors ADS represents and in the Q3 2023 industry outlook survey all members and sectors said they saw growth opportunities for their businesses.

The majority of respondents (63%) identified export sales as an area of business growth in Q3. This was closely followed by 55% of respondents who said they are expecting business growth to come from domestic sales. This is the inverse of Q2, where domestic growth opportunities were identified by more respondents as the expected growth area. 50% of survey respondents identified increasing employee headcount as a growth area of Q3. Finally, just over a third expect that securing work on government contracts will contribute in part to their expected growth opportunities.

Acknowledging the ongoing widespread confidence that we have seen respondents exhibit throughout 2023, there are still various macro factors that are impacting on businesses. Only 2.4% of respondents reported that current geopolitical conflicts will not have an impact on their business in Q3 2023, which is likely reflective of the ongoing war in Ukraine and other bubbling political tensions that were occurring in Q3.

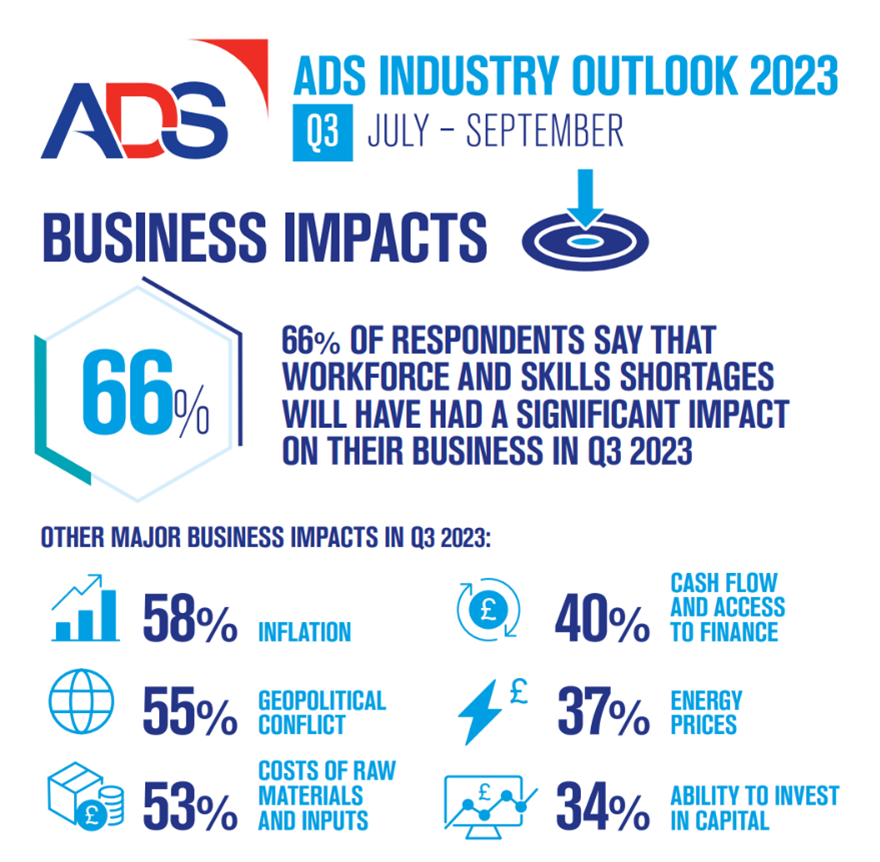

When ranking thematic issues that will have an impact on their businesses in Q3 2023, workforce and skills shortages was recorded by two third of respondents as having a significant impact on business growth opportunities in the next three months.

Discussions across the ADS membership indicate that a desire to increase headcount is being met with increased wage inflation and ongoing skills shortages, which are impacting firms’ ability to increase output levels and their overall growth prospects. Inflation, and the associated cost of raw materials and inputs, has also been recorded as having a significant or neutral impact by two-thirds of survey respondents in Q3 2023.

Interestingly the top significant impact in Q3 is recorded as workforce and skill shortages; in Q2 this was geopolitical conflict; and in Q1 2023, energy prices were the most significant issue in Q1. This Industry Outlook survey is instrumental in helping to highlight the issues that ADS needs to represent to stakeholders and policy makers. Challenges around skills and workforce shortages are already being approached from several angles within ADS including the new HR & Legal Forum, as well as a specific campaign on reform to skills policy.

About the survey:

At the midpoint of each quarter, ADS will survey member companies through the ADS Industrial Outlook to get a temperature check on current trading conditions and a view on the outlook for the year ahead. In September 2023, the survey was open for two weeks and secured 38 responses across the membership. Circa 750 senior leadership and decision-making members were contacted. The majority of respondents (83%) were manufacturing or technology businesses.

For further details please contact Aimie Stone, Chief Economist,

aimie.stone@adsgroup.org.uk