Business confidence remains high in Q2 as challenges to growth start to shift

At the time of the Q2 survey in late May, I hope it is fair to suggest that bank holiday season had generated some positivity and optimism into the survey respondents. The continued confidence shown feels slightly confusing in the current macro-economic news cycle of stubborn inflation at 8.7% in June and interest rates that are expected to continue to rise. That being said, the percentage of respondents expecting business turnover to grow or stay the same in Q2 2023 (compared to Q1) has fallen slightly on the percentage of those expecting the same in Q1 2023.

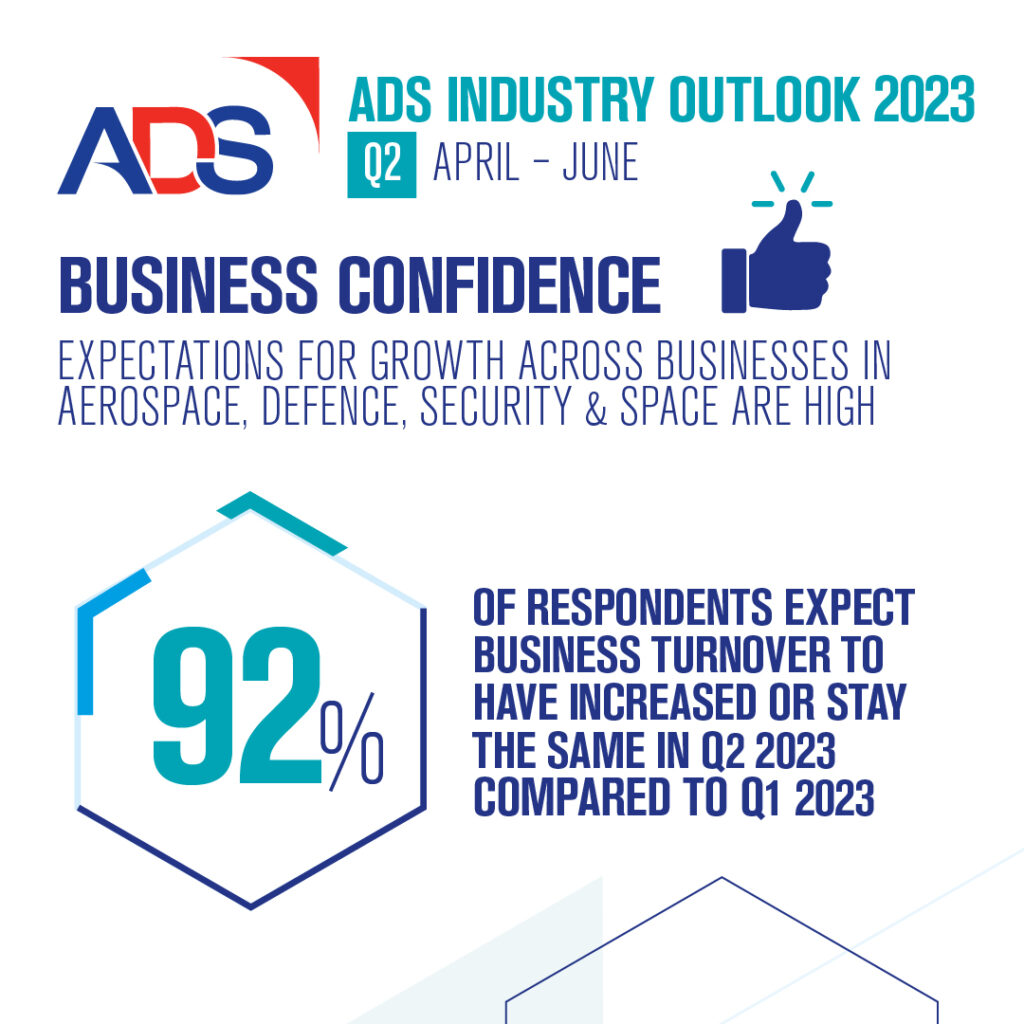

In line with last quarter, ADS surveyed our members on their outlook and intentions, this time for Q2 2023. The ADS Industrial Outlook 2023: Q2 found continued encouraging responses, with 92%, the majority of member respondents, expecting business turnover to grow or stay the same in Q2 2023.

Data published by ONS showed that UK real GDP grew in Q1 2023, by 0.1% on Q4 2022. Early indicators for Q2 (April data) suggest monthly growth of 0.2%, with growth supported by the services sector alone, with production output and construction showing a decline in April. Monthly manufacturing output decreased by 0.3% in April 2023.

This is against the trends we are seeing in aerospace, which has been relatively flat or showing marginal improvements since the start of the year. By end Q1 2023 aerospace manufacturing had grown 0.3%, and the month of April saw growth of 0.9%. This incremental growth seen in aerospace output is reflective of recovery expectations in the sector, that are warming up for increased production rates.

Other data supporting this trend is the global aircraft orders and deliveries book. June saw the return of the Paris Airshow which recorded the largest ever order of new aircraft from one airline to manufacturer, with 500 aircraft orders placed, indicating a significant level of confidence in the sector and desire for new aircraft. At the end of May 2023, the backlog order book for aircraft data was close to 13,5000 indicating at least 10 years’ worth of work at current production rates. Encouragingly, demand for travel continues to recover as well, with UK flights and arrivals data at the midpoint of June less than 10% below 2019 on a seven-day moving average.

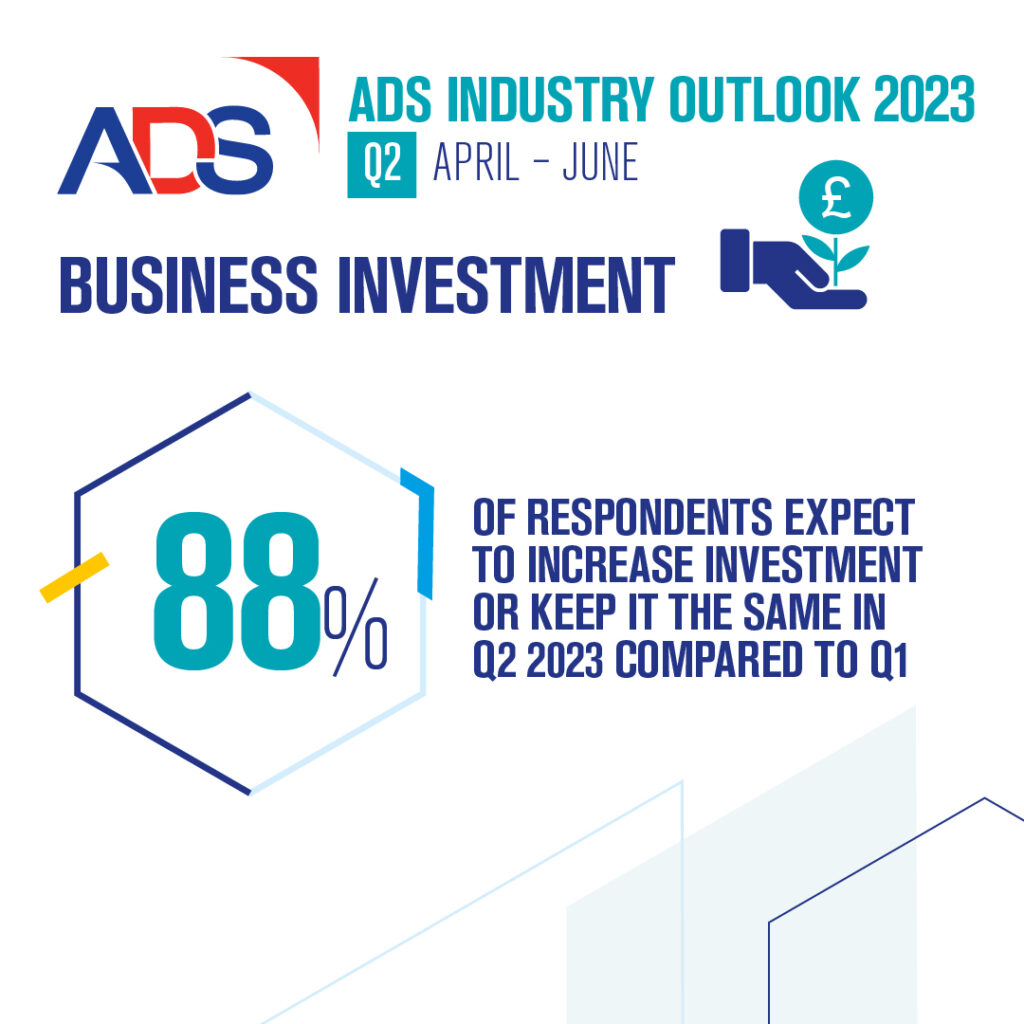

The majority of member respondents are also expecting to increase their investment in Q2 2023, with 88% of respondents expecting to increase investment or keep it the same compared to the previous quarter.

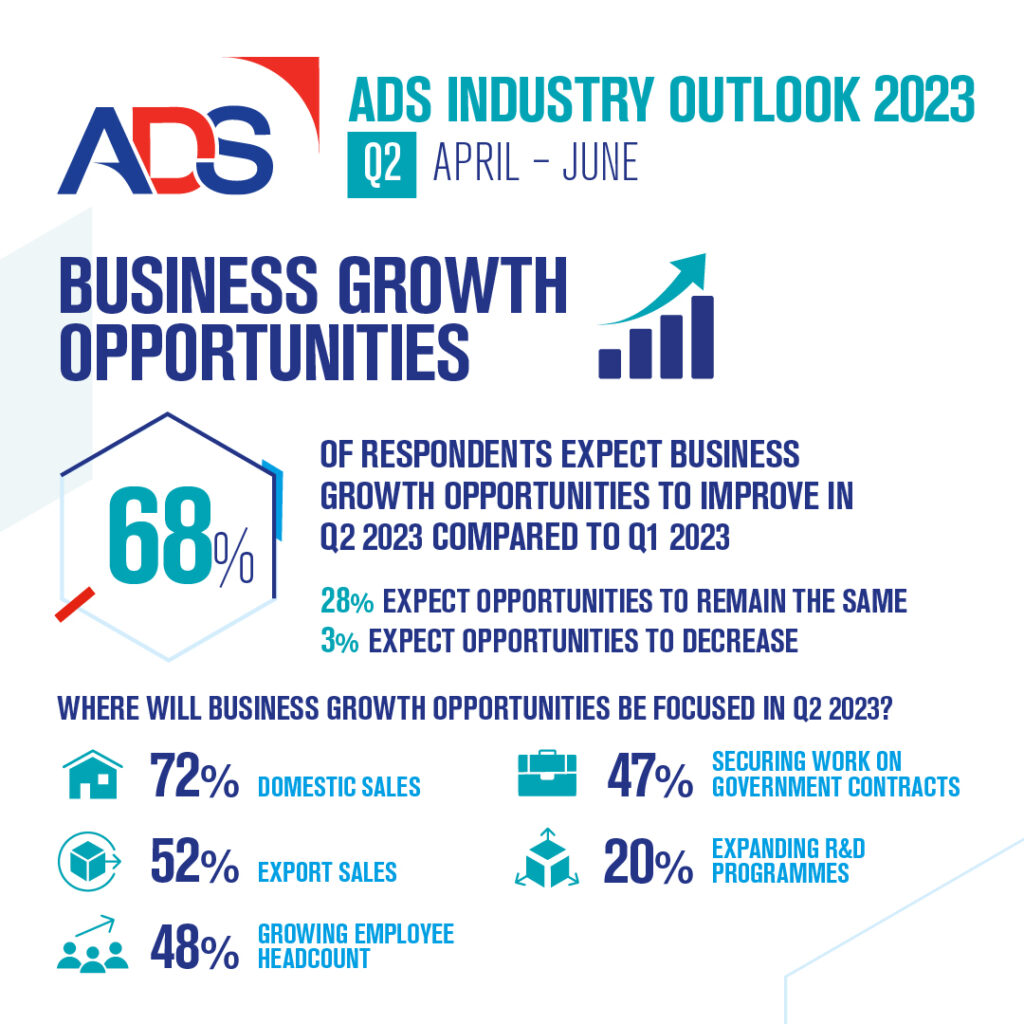

This quarter we asked ADS members about the growth opportunities they are anticipating in Q2, with 68% of respondents stating that they expect opportunities to improve on Q1 2023. When asked where growth opportunities may be found, the majority, 72% of respondents expect growth opportunities to improve from domestic sales. The majority of respondents, 52%, also anticipate that growth opportunities will come from export sales, with increasing employee headcount, securing work on government contracts and expanding R&D programmes all contributing in some part to the expected growth opportunities.

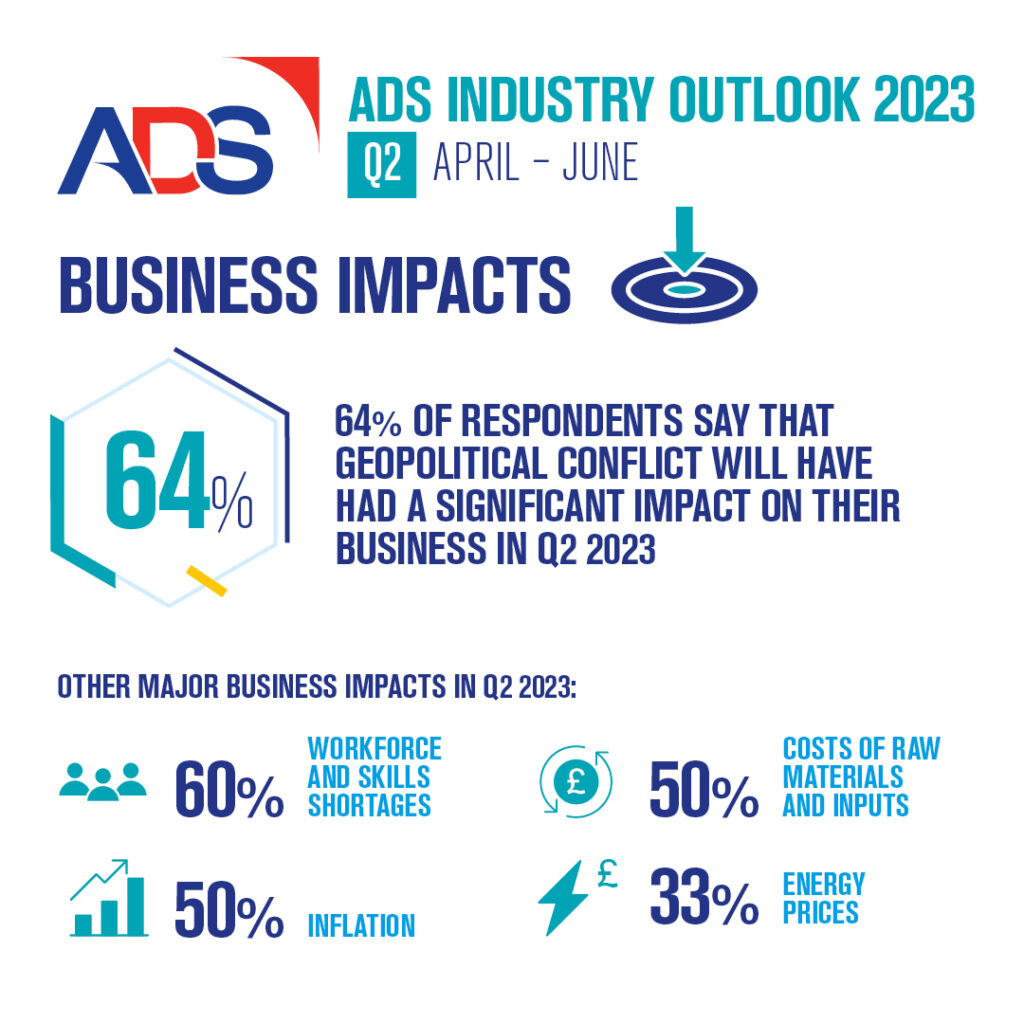

Acknowledging the reported confidence in Q2 2023 and expected areas for growth opportunities, there are still various macro factors that are impacting on businesses. 64% of respondents say that the geopolitical conflict will have had a significant impact on their business in Q2 2023, this is likely reflective of Russia’s ongoing illegal war on Ukraine.

When ranking themes that will have an impact on business workforce and skills was recorded by 60% of respondents as having a significant impact and we can assume this is meant in a negative sense with a need to grow headcount and address the skills shortages. Inflation and the cost of raw materials and inputs has also been recorded as having a significant impact by 50% of survey respondents in Q2 2023.

About the ADS Industrial Outlook 2023 Q2 Survey:

At the midpoint of each quarter, ADS will survey member companies through the ADS Industrial Outlook to get a temperature check on current trading conditions and a view on the outlook for the year ahead. In May/June 2023, the survey was open for two weeks and secured 60 responses across the membership. Circa 750 senior leadership and decision-making members were contacted. The majority of respondents (83%) were manufacturing or technology businesses.

For further details please contact Aimie Stone, Chief Economist, aimie.stone@adsgroup.org.uk