Written by Aimie Stone, ADS Chief Economist

Setting the scene in Q1 2023 might prove more difficult than businesses would like, following a challenging 2022. The continuation of difficult circumstances especially for the supply chain with the rising cost of doing business against a back drop of rising demand. The UK continues to experience double-digit inflation and although there have been some government interventions, rising energy prices continue to be a cause of concern for both house-holds and businesses.

The latest data published by the ONS provides a first look at GDP in 2022. Narrowly avoiding a recession in Q4 2022 with flat growth, UK GDP grew 4.1% in 2022. Digging a little more at the manufacturing data with an aerospace lens, we see that manufacturing output remained unchanged in Q4 2022 and within this, aerospace manufacturing output actually saw growth of 0.1%. The incremental growth seen in aerospace output is reflective of recovery expectation in the sector.

Other data supporting this trend is the global aircraft orders and deliveries book. At the end of 2022 orders for new aircraft were the highest since 2015 and whist deliveries are not quite at pre-pandemic levels yet, they are the best they’ve been for 2 years. The backlog order book for aircraft data has been above 13,000 for 15 consecutive months indicating at least 10 years’ worth of work at current production rates. Encouragingly, demand for travel continues to recover as well, with UK flights and arrivals data towards the end of March just 11% below the same day in 2019. Travel to visit friends and relatives leads the recovery.

The backdrop that the Chancellor delivered his Spring Budget against saw both households and businesses crave certainty about the future of rising costs. At the same time, the UK needs to be seen as the place to invest, especially for long term decarbonisation targets to be met and delivered upon, this is especially important in response to the US’ Inflation Reduction Act.

Elsewhere, Russia’s war on Ukraine has persisted for over a year, the UK has continued its commitment to help support Ukraine and the Spring Budget saw an increase of £11bn in defence spending over the next five years. Which highlights the need as well to ensure UK national security.

In February of Q1, ADS surveyed our members on their outlook and intentions for 2023. The ADS Industry Outlook 2023: Q1 Survey found encouraging responses, that the majority of members expect this year to see increased turnover compared to 2022, with only 4% expecting a decrease.

The majority of member respondents are also expecting to increase their investment in 2023, and when asked where this investment will take place, the answers of staff training and also requirement chime well with ADS focus campaign for the year on the skills agenda. There is a policy need to revisit the Apprenticeship levy, as well as work ADS and our members are undertaking to identify future skills needed amidst new technologies, as competition for highly skilled workers rises and pushes up wages along the way.

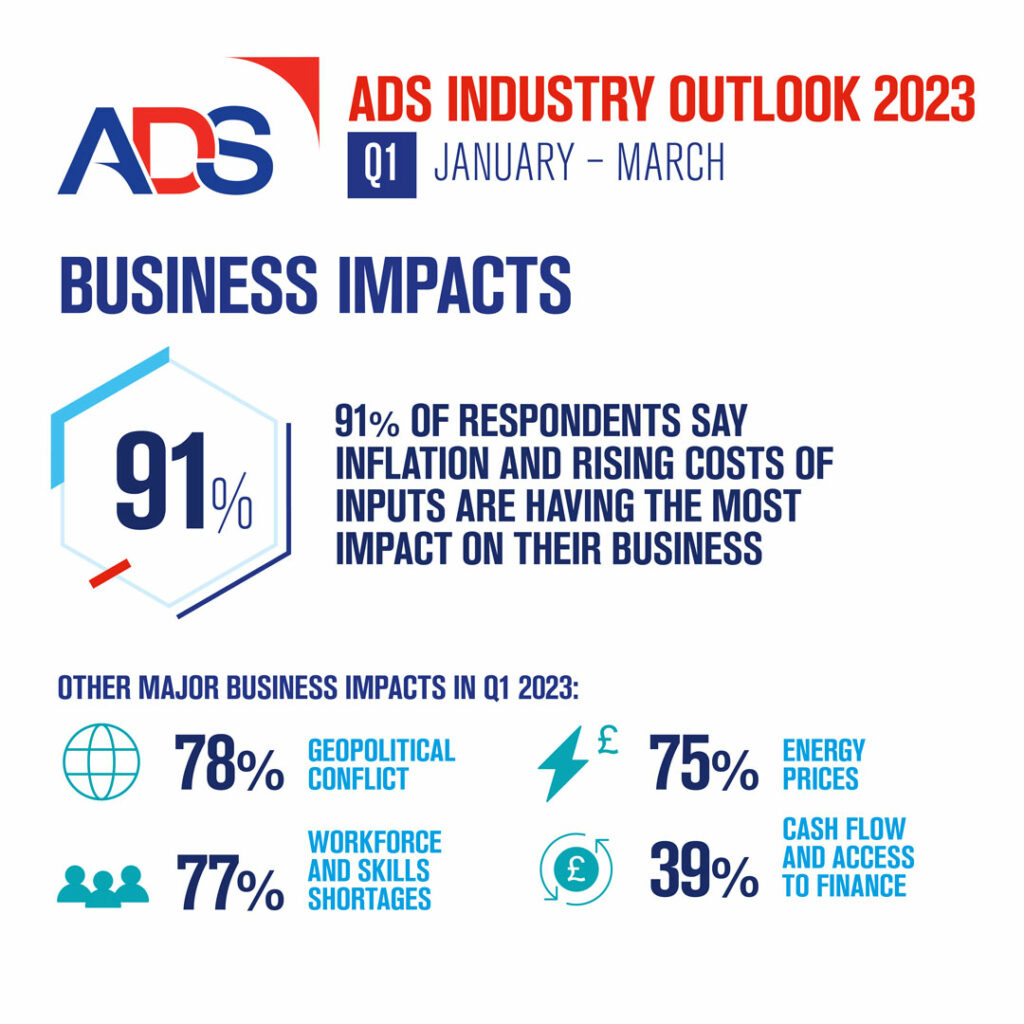

Despite the optimism for increasing business turnover and investment in 2023, it is not a surprise that inflation and rising costs of inputs is the biggest issue facing our survey respondents with 91% suggesting it will have a significant or very significant impact on their business. When ranking challenges, this is firmly at the top, with geopolitical conflict, workforce and skills shortages and energy prices a significant concern for at least three quarters of members who responded.

About the ADS Industrial Outlook 2023 Q1 Survey:

About the ADS Industrial Outlook 2023 Q1 Survey:

At the midpoint of each quarter, ADS will survey member companies through the ADS Industrial Outlook to get a temperature check on current trading conditions and a view on the outlook for the year ahead. In February 2023, the survey was open for two weeks and secured 92 responses across the membership. Circa 750 senior leadership and decision-making members were contacted. The majority of respondents (82%) were manufacturing or technology businesses.

For further details please contact Aimie Stone, Chief Economist, aimie.stone@adsgroup.org.uk