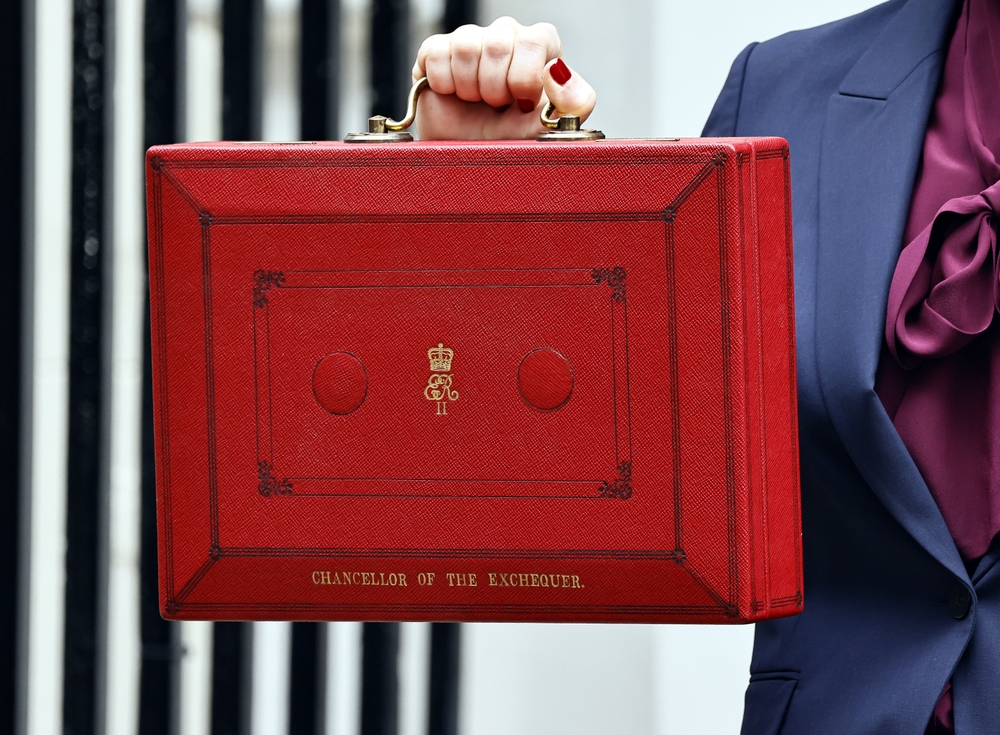

On 26 November 2025, the Chancellor of the Exchequer, Rachel Reeves, presented the Autumn Budget to Parliament. Its tax-raising measures are worth about £26bn, with the freeze on personal tax threshold and the cap on salary-sacrificed pension contributions accounting for over half of that.

The overall impact of the Budget is to increase public spending and borrowing initially, with large tax increases and spending cuts following thereafter in order to theoretically balance the books.

The Autumn Budget did not offer any significant developments in terms of clarifying the pathway on defence spending or implementation of the Industrial Strategy and other key policies.

The key highlights for ADS sectors include the following – members can login to read our full analysis.

Commenting on the announcement, ADS CEO Kevin Craven said:

After a year of welcome – but mostly high-level – policy announcements from the Government, including on energy and finance this week, today’s lacklustre Autumn Budget could have provided more detail to deliver these strategies and drive growth.

With the tax burden projected to reach an all-time high for UK businesses by 2030–31, the Government absolutely must prioritise driving investment in a globally competitive marketplace.

While today’s Budget rightly recognises the critical role our sectors play in national security and prosperity, the pathway to spend 3.5% of GDP on defence by 2035 unhappily remains unclear.

We acknowledge that the macro and geopolitical landscape has shifted dramatically in recent months, let alone since the last Budget. However, support and stability for our businesses should not be overlooked, given they employ over 440,000 people across the UK.

A member of ADS? Click login in the top right corner to access our member area. Create an account by registering on the landing page – here you can access all of your membership benefits. Any employee of a member company can create an account.