0.5 percent GDP growth in May 2022 comes as unexpected growth as the cost-of-living-crisis looms over UK consumers and businesses. The latest data also sees revisions to April 2022 GDP, suggesting a fall of just 0.2 percent rather than the previously estimated 0.3 percent decline. UK GDP is now estimated to be 1.7 per cent ahead of February 2020 pre-pandemic levels.

The growth comes as somewhat of a surprise as many forecasters were anticipating flat output for May. However, economic growth occurred in all major output areas of the economy, production, construction and services output all saw monthly growth in May 2022 of, 0.9 percent, 1.5 percent and 0.4 percent respectively. Construction output is leading the rise in GDP, experiencing the seventh consecutive month of growth in May 2022.

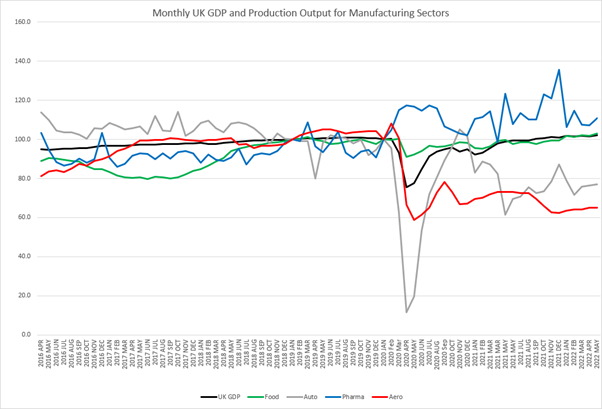

Manufacturing output leads production growth

Monthly production output is now just 0.5 percent behind pre-pandemic levels of February 2020, with manufacturing supporting the increase in output for May 2022. Manufacturing production output increased by 1.4 percent in May 2022, which makes manufacturing output now 0.1 percent above where it was in February 2020. Twelve out of thirteen subsectors of manufacturing experienced growth in May 2022, showing that growth is varied and widespread.

Pharmaceuticals saw robust growth resurgence of 3.3 percent for the month, and only a few manufacturing subsectors now have output below that of February 2022. Of the four sectors that we typically compare, pharmaceutical output is1.8 percent ahead of pre-COVID trends, and food manufacturing out 2 percent ahead. Automotive production saw monthly growth of 1.3 percent but remains 22.3 percent below pre-pandemic output, owing to consumer demand woes as well as production challenges and over the last two years.

When we look at aerospace manufacturing output, the monthly figures are also positive, in line with the majority of manufacturing. Growth of 0.3 percent is welcomed, although marginal, given the months of flat figures following production slowdown during the pandemic as international air travel faced ongoing restrictions.

Now that travel is more accessible, the sector faces new challenges from a supply perspective of rising input costs of materials, logistics challenges and labour shortages leading to wage inflation. On the demand side the cost-of-living crisis ultimately could disrupt the fragile recovery we have seen as households face rising bills and pressures.

Aerospace output remains subdued

Aerospace is the manufacturing sector that remains significantly weaker than in February 2020 and remains 37.9 percent smaller in terms of output.

The repair and service side of aerospace also saw monthly growth in May 2022, of 2.8 percent, but this side of the sector is still 32.1 percent below February 2020 output levels, as maintenance and repair services are in lower demand more generally with fewer flying hours undertaken. There is some optimism to be had with UK flight data for arrivals and departures at the end of May 2022 just 12% behind the same week in 2019.

The chart shows the low and flat output for the aerospace manufacturing sector against the other high value manufacturing industries and UK GDP. Although the monthly growth in May is a positive step, we await more months of consistent growth in order to signal a real recovery starting. Expectations remain that flight recovery comes first, with orders and deliveries of aircraft to follow, once manufacturers ramp up rate, and supply chains can cope with the increase we should see this feed into the UK manufacturing output figures. If the current challenges facing the supply chain, this may be a little while off yet.