UK GDP saw a decline in 2020, this is no surprise given that we have been going through a global pandemic. The 9.9percent reduction in UK GDP is significant and far greater than any other for at least 300 years. The UK is 6.36percent smaller at the end of 2020 than it was in February 2020, before the pandemic really took hold.

The quarterly data is a little more interesting as UK GDP saw 1percent growth in Q4 2020 despite a number of regional restrictions in place throughout the winter months. This small growth may be subject to revisions, but it is noticeably a long way off the 16.1percent growth seen in Q3 2020, as once again in Q4 many sectors of the economy were forced to close and no longer contributing to economic growth as they had been in previous quarters.

Production, Services and Construction all saw growth in Q4 2020 despite varying Covid-related restrictions. Of interest to our sectors, production output in the fourth quarter achieved 1.8percent growth, which follows on from recent subdued production figures each month. Many sectors have continued to adapt to Covid safe working conditions where they are allowed to continue to operate.

Manufacturing Production remains stable but weak

Manufacturing continued to recover and contribute to production output growing by 3.3percent in Q4 2020. This marks eight months of consecutive manufacturing growth. Manufacturing of transport equipment was a significant contributor in Q4 with some pull forward of demand to offset Brexit impacts at the end of the transition period at the end of 2020. Chemicals manufacturing also saw a significant growth in Q4 with an increase in COVID-19 testing and equipment.

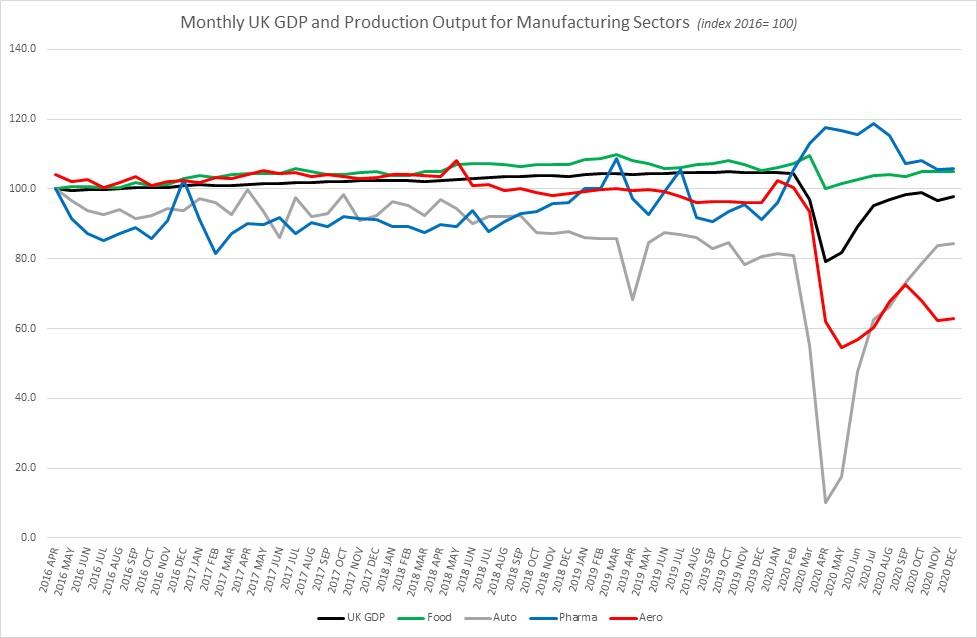

When we compare similar manufacturing sectors to aerospace, we can see the gains being made in other sectors towards a recovery are not happening for aerospace as restrictions and lack of demand continue to hold up potential growth.

Many sectors saw weak monthly growth including aerospace, automotive, pharmaceuticals and food manufacturing, however, this picture is much more widespread at a quarterly level, with both pharmaceuticals and aerospace experiencing declines. Automotive and pharmaceuticals have now grown past levels of February 2020 (pre pandemic) but food manufacturing is still 2.2percent smaller than it was, and aerospace manufacturing is a staggering 37.4 percent behind output levels of February 2020.

Aerospace output and repair – weakest performing subsector of manufacturing

Aerospace manufacturing saw growth in December 2020 of 0.8 percent which is minimal and likely linked to end of year ramp up to secure delivers on some aircraft. The repair and service side of aerospace reportedly shrank again by 1.1percent in the month of December.

Looking at quarterly data, aerospace manufacturing shrank 3.5percent between Q3 and Q4 and repair and service by 14.5percent. None of this is a surprise to those operating in the sector who are experiencing first-hand the rate reductions, lack of demand and full impacts of the travel restrictions in place as a result of the global pandemic.

Aerospace manufacturing and repair sectors continue to struggle in terms of Covid recovery and are lagging significantly behind other high value manufacturing sectors. The little monthly growth we have infrequently seen is often subject to revision meaning that these incremental movements cannot be an indication of sector recovery, we need to see sustained, substantial growth for that to be true, which won’t likely come until the economy and border are reopened when safe to do so, as it stands, with an absence of direct government support the near-term the outlook for the sector continues to look bleak.