As per expectations November lockdown put a stopper in growth. UK GDP fell by 2.6 percent in November 2020 from October 2020, following six months of growth. The second lockdown across England saw businesses forced to close once again which leaves the UK 8.5 percent smaller than it was February 2020 (pre-pandemic).

Understandably, services saw a widespread decline and acted as the main drag on growth in November. The monthly decline of services output by 3.4 percent reflects the restrictions in place during the month, and after a difficult time of closing and reopening throughout the last seven months the services sector is now 9.9 percent below February 2020.

We have one more month to wait for December results, a look at Q4 and round up of 2020. But what we can tell from the marginal October growth of 0.4percent, the November decline of 2.6 percent and the turbulent economic activity in December 2020 full of tiered systems and a cancelled Christmas, will most likely deliver indications of an economy in decline. Whether or not this turns into another recession in 2021 depends upon the ability of the economy to reopen in March, which hinges on the successful roll of the vaccine and ability to reduce UK COVID-19 infection rates.

Manufacturing Production remains stable but weak

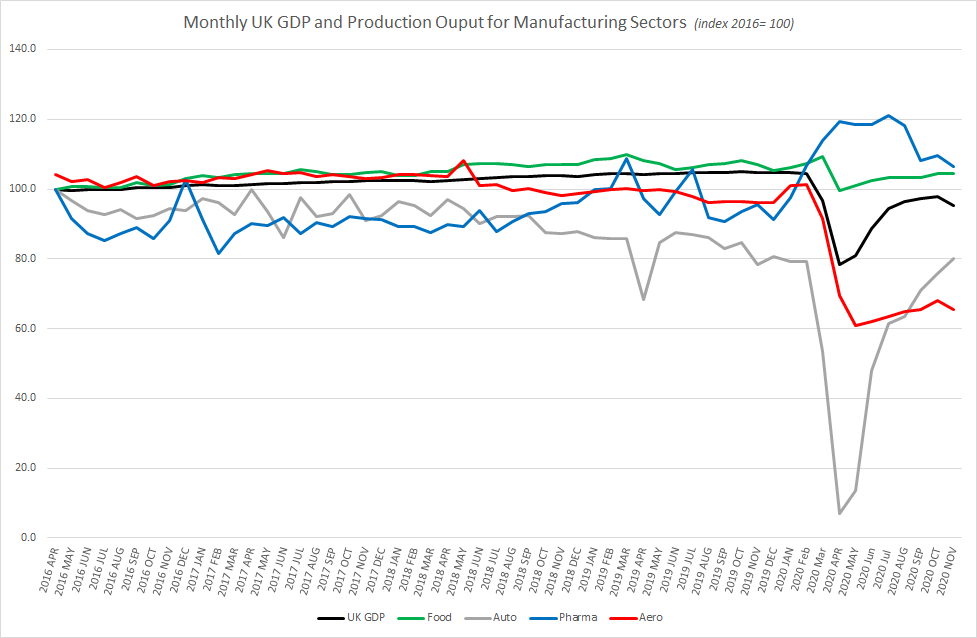

Production Output fell by 0.1 percent between October and November 2020 following recent weak growth, and on a while remains 4.7 percent below pre-pandemic levels of February 2020.

A number of more industrious sub sectors experienced a decline in output in November, including mining, electricity and gas, water, and waste. Manufacturing as a sub sector of production actually grew between October and November 2020 but by just 0.6 percent, which is weaker than the 1.7 percent growth seen in previous month. The constructions sector also saw growth and is now back above pre-pandemic levels.

Manufacturing sites across the UK have continued to adapt to social distancing requirements, restrictions, and increased Covid-safety measures at the workplace, which means during this lockdown 8 of the 13 subsectors were able to display upward contributions.

Transport equipment led the manufacturing growth for November with an increase of 2.3 percent. However, this is 13 percent weaker than in February 2020, albeit from a low base. According to the office of national statistics motor vehicle exports are to thank for the spur in growth this month.

When we compare similar manufacturing sectors, we can see the gains being made in other sectors towards a recovery are not happening for aerospace as restrictions and lack of demand continue to hold up potential growth.

Aerospace output and repair – weakest performing subsector of manufacturing

Aerospace manufacturing is the sub–sector still furthest behind pre-pandemic output levels at 35.8 percent smaller than February 2020. The repair and services side of the sector is statistically the weakest performing of all manufacturing subsectors compared to pre-pandemic output having declined by 39.2percent since February 2020.

The sector output decline in November and ongoing struggle will likely not come as a surprise to many in the industry who are seeing first-hand the impacts of low demand in the sector. With no signs of relief as restrictions and travel bans only on the rise, with an absence of direct government support the near-term outlook for the sector remains bleak.

As always, we look to quarterly data to make any more serious estimates about the future recovery for our major industries and the UK economy, but the national restrictions that came into force in November will no doubt wipe out what little growth we did see for the UK Economy this month.