One percent UK GDP monthly growth in June 2021 sounds subdued, but the gradual increases over the last few months in UK output has resulted in quarterly growth of 4.8 percent in Q2 2021. Growth for Q2 was weaker than expected but wider reports suggest that consumer spending priorities are shifting as the economy reopens. UK GDP remains just 2.2 percent lower than it was pre-pandemic in February 2020.

‘Freedom Day’ and the impact of further easing of restrictions will be shown in the July data, with a continued successful vaccination programme in the UK, and hopes that there are no further waves of lockdowns ahead, there are expectations that Q3 will show even stronger economic recovery.

Production output fell by 0.7 percent in June 2021, with quarterly output increasing by just 0.5%. There were planned closures and maintenance work in June 2021, alongside decreased demand levels ford some areas, production output remains 3.2 percent below pre-pandemic levels. The service sector saw stronger monthly growth, and output grew by 1.5 percent in June 2021 but remained 2.1 percent below its pre-pandemic levels.

Manufacturing Production remains stable but weak

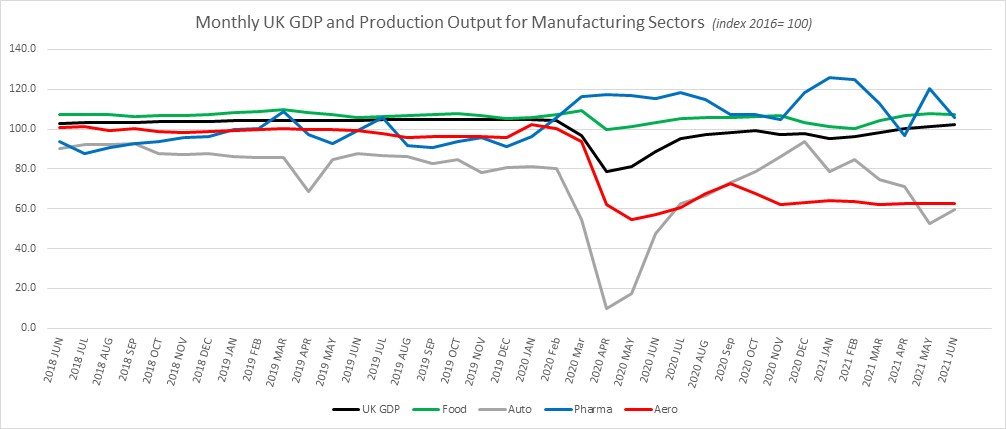

Manufacturing production output increased by just 0.2 percent in June 2021, which makes manufacturing output 2.3 percent below where it was in February 2020. Fluctuations in pharmaceutical output which decreased by 13.4 percent in June 2021 have influenced the monthly manufacturing figures. Despite this, eight out of 13 subsectors saw growth which continues to have a positive impact on manufacturing which has seen five months of consecutive growth.

The current global chip shortage that impacted production in May 2021 eased in June. The largest contribution to the increase came from the manufacture of transport equipment, which grew by 7.4 percent.

Aerospace output remains subdued owing to global travel restrictions

Aerospace is the manufacturing sector that remains significantly weaker than in February 2020, at 37.7 percent smaller in terms of output. However, both monthly and quarterly growth output figures are flat, this is a positive for a sector that has seen constant decline in recent months. The stabilizing of aerospace manufacturing output, albeit at low levels, coupled with further signs of UK travel opening in coming months with countries with successful vaccination programmes, should provide a positive indicator to the sector. However, international travel on a larger scale remains on hold for now as new variants of COVID halt the reopening of global travel and increased production of aircraft for UK manufacturers. The aerospace sector output has recovered slightly from the depths of 2020, with output 10 percent higher in June 2021 than the same time a year earlier.

The repair and service side of aerospace reportedly also shrank in June 2021, by 6.3 percent. This means the combined sector output is now 41.1 percent smaller than it was in February 2020. Further reopening of air travel in July might see the demand for MRO and service work increase, we await next month’s data to assess any material impacts this may have had.

The chart shows the low and flat output for the aerospace sector compared to other manufacturing industries and total UK GDP. More turbulent times in adjacent sectors in recent months are evident, but the prolonged low levels of output for aerospace will create long term distortions in UK competitiveness of the industry if left without intervention.