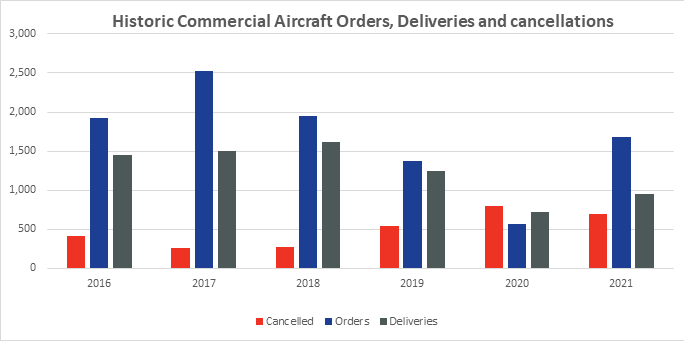

When looking at the health of the aerospace sector, the global aircraft orders and deliveries data is a key indicator. The impact that COVID-19 has had on the sector has been significant and this is noticeable from travel restrictions that have grounded growth in the aviation sector more generally.

Orders of Global Aircraft

Aircraft orders saw significant growth in 2021 on 2020 and also more orders placed than in 2019. Over the course of the year, some months have seen large numbers of orders placed, to note, March, June, November, and December. A boost in orders at the quarter end is quite common and can been seen across previous years. The large influx of order in November 2021 can be attributed to the Dubai air show and the positive outlook of easing travel restrictions.

In total 1680 new aircraft orders were placed in 2021, which is a 196 per cent increase on 2020. Orders of both single-aisle and wide-body aircraft saw a return to growth at +204 percent and +147 percent respectively, although, wide-body orders are still about half that of an average year.

Delivery of Global Aircraft

Delivery of global aircraft give a better sense of the health of the sector and the growth in delivery numbers of aircraft in 2021 is a positive signal that things are heading in the right direction. In total aircraft deliveries were up by 32percent, peaking at 951 deliveries made which is 228 more than the previous year.

Deliveries of single-aisle aircraft grew for the first time in two years, up by 51 percent for the year, but unfortunately wide-body deliveries fell a further 20 percent from the low 2020 levels and is the lowest annual figure seen since records began. The ongoing decline of global wide-body aircraft delivery can be attributed to a lack of resurgence in the international travel (long haul) as a result of the ongoing pandemic.

Pandemic impacts

When the pandemic first hit, airlines and leasers were unable and unwilling to accept delivery of new aircraft and we also saw manufacturers cut the rates at which they were producing them. As we enter into 2022, there are a new set of challenges, unfortunately most of these once again facing the manufacturers and the supply chain.

As the aerospace manufacturing sector looks to recover from COVID-19 there are reports of trouble access raw material, especially high specification material and also constraints around availability of treatment plants. In a survey the ADS undertook in December 2021, 69% of respondents reported that they had seen disruption to supply of raw materials / components / packaging / parts or equipment in recent months alongside 60% of respondents who reported labour shortage due to recruitment and retention pressure.

As the global aircraft manufacturing sector is gearing up to a rate increase in the near future, these challenges being felt in the UK could put UK aerospace manufacturing recovery at a further disadvantage. With production output already 38 percent behind February 2020 (pre pandemic) levels it is essential that the supply chain challenges are resolved quickly.

Other activity and engines

Aircraft backlog orders fell for the third consecutive year by 7 per cent in 2021 but ended the year larger than at the start. The value of aircraft backlog is estimated to be worth £190bn to the UK. Cancellations, whilst still high at 689, fell on the year compared to 791 cancellations seen in 2020, most of which over both years can be linked to challenges seen with one specific single-aisle aircraft.

Behaviour of engine data mirrors that of aircraft with growth seen in orders of engines and installs across 2021. 2021 saw orders increasing by 225 percent and installs up by 40 percent on 2020. As with aircraft the 2021 figure for widebody engine installs is the lowest figure in over 10 years. The engine backlog fell for the second consecutive year by a marginal 0.2 percent in 2021 but still stands extremely strong at 25,088 engines on firm backlog order at the end of 2021.

Global deliveries of aircraft felt just short of ADS forecast in 2021, but the scale of growth is still notable and encouraging as we head in 2022. Once manufacturers publish rate anticipations for this year, ADS will look to publish our delivery forecast at the end of Q1.