What the Deal means for the UK border:

The UK has left the EU and the transition period has officially come to an end. An agreement was reached and on Christmas Eve the Trade and Cooperation Agreement was published.

The deal means the UK Government have been able to make some amendments to the Border Operating Model (BOM). The customs chapter in the deal does not fundamentally change many of the requirements and processes contained in the Border Operating Model but does mean zero tariffs and zero quotas.

Previous versions of the BOM

Consider this the BOM V.3. following two previous versions in July and October. Updates to the model were made on 31 December 2020 and came into force the next day. There are a number of new actions that will still be required to move goods between GB and the EU which were previously covered. Areas that are new or have changed include:

What is in the new BOM V.3.? – relevant for members

Rules of Origin

For UK tariffs and EU tariffs there is a new paragraph on the preferential Rules Of Origin (RoO) that apply. Businesses will need to prove origin of goods in order to benefit from preferential tariffs.

Facilitations

Mutual recognition of AEO status has been agreed mutual recognition of AEO schemes with the EU. AEO status is an internationally recognised quality mark that shows a business’s role in the international supply chain is secure and has customs control procedures that meet UK and EU standards.

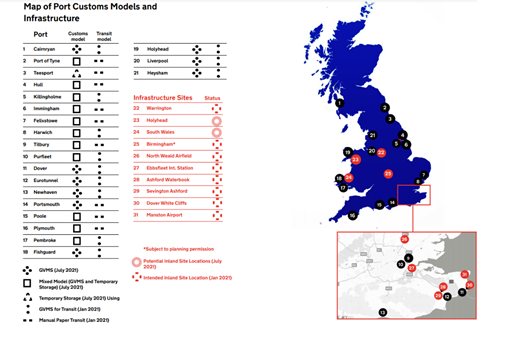

Border Locations

Details on which border locations are operating which customs model and further specific requirements and details for traders, hauliers, carriers and border operators has now been made available alongside a simple map which is posted later in this blog.

Collection of Intrastat Data

HMRC will continue to require that all VAT registered businesses currently required to submit monthly Intrastat arrivals declarations for goods imported from the EU to GB carry on submitting these from 1 January 2021 for all of 2021.

Intrastat will continue to apply for at least another 4 years for movements of goods to or from NI and the EU to meet the requirements of the Northern Ireland Protocol.

Simplified Customs Declarations for Imports

The new guidance explains in further detail the liability that intermediaries will have, which ultimately does not change. They will need to carry out due diligence checks but the trader will be solely liable for any debts arising.

Returnable Packaging

Reusable packaging is eligible for a relief on customs duties. To claim import relief the packaging must have been previously exported or used to import goods. To import reusable packaging, you can either make an electronic customs declaration, or where there is an available facilitation you can make a declaration by conduct or an oral declaration to the temporary admission or free circulation procedures. Further guidance is available online.

Everything Else

Less relevant to our sectors is guidance on the movement of plants and organics and other ore certificated and restricted goods. The latest updates to the BOMV.3. will provide some clarity to businesses on areas that were still subject to outcome of negotiations.

Gov.UK also now contains a series of case studies, to represent end-to-end scenarios that will happen between GB and EU, importing and exporting goods from January 2021.

As more guidance is published we will continue to update the ADS Brexit Hub, and are also kicking off our Managing Brexit webinar series next week, which members can sign up for now.