Yesterday the UK Government published version two of its proposed Border Operating Model (BOM). This follows on from an earlier version in July which ADS blogged about at the time.

The BOM V.2 does not see many changes to the previous text but does come with added detail on many areas that ADS and wider industry had called for. Industry will have the opportunity to discuss the BOM with HMG in the coming weeks, and this remains a live document.

The 272-page document is very extensive, and on page eight there is a guide to the additional material which should make it a little more digestible. A few of the new additions to highlight to members include:

New infrastructure requirements including locations

HMG is proposing a number of inland locations to provide Common Transit Convention facilities from 1 January 2021. The use of these sites is subject to securing any necessary planning and regulatory approvals. Details of proposed locations and a Map of other potential inland sites are included in the BOM V.2. Unsurprisingly there are a number of sites in Kent to serve the UK’s major freight transit routes between Dover and Calais or Dunkerque, and the Channel Tunnel.

Delayed customs declarations and the requirements of Entry in Declarants Records (EIDR)

BOM.V2 provides details of what information traders need to include when entering goods into their own records, before filing supplementary declarations within six months of the goods arrival. The BOMV.2 also contains conditions under which this cannot be done, for example on controlled goods.

The approach to liabilities for intermediaries

Traders choosing to use an intermediary to help with customs processes need to ensure that they as the trader, or the intermediary they’re using, are authorised for Simplified Customs Declaration processes and have a Duty Deferment Account.

Non-UK established traders must use a UK established agent with access to an authorisation for the Simplified Customs Declaration process for imports and a Duty Deferment Account.

Collection of Intrastat Data

VAT registered businesses currently required to submit monthly Intrastat arrivals declarations will be required to carry on submitting these from 1 January 2021, to the same timelines.

Check an HGV is Ready to Cross the Border Service – Formerly known as Smart Freight Service

For outbound UK-EU freight vehicles, drivers will be able to check that they have the correct customs and border paperwork at the point of pickup of the goods.

Everything Else

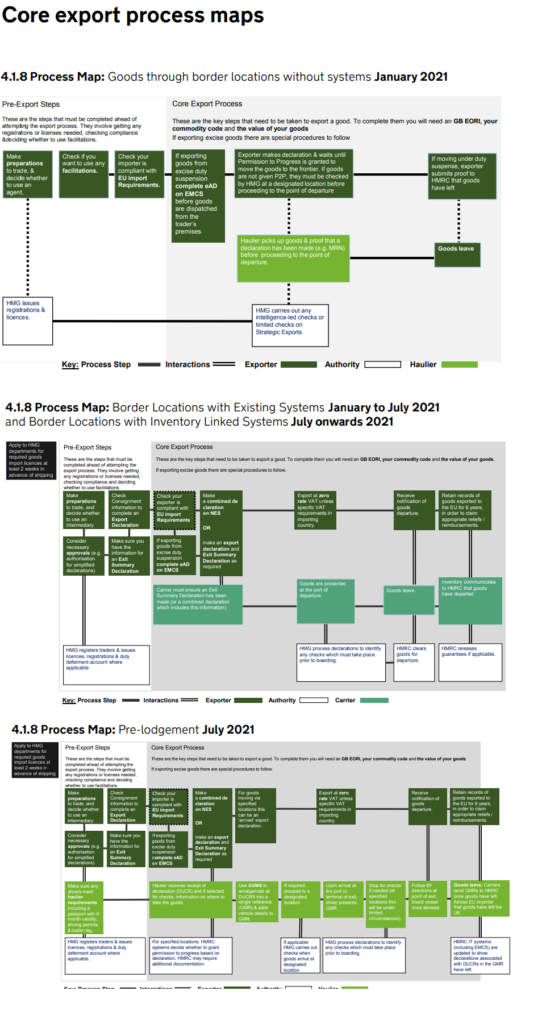

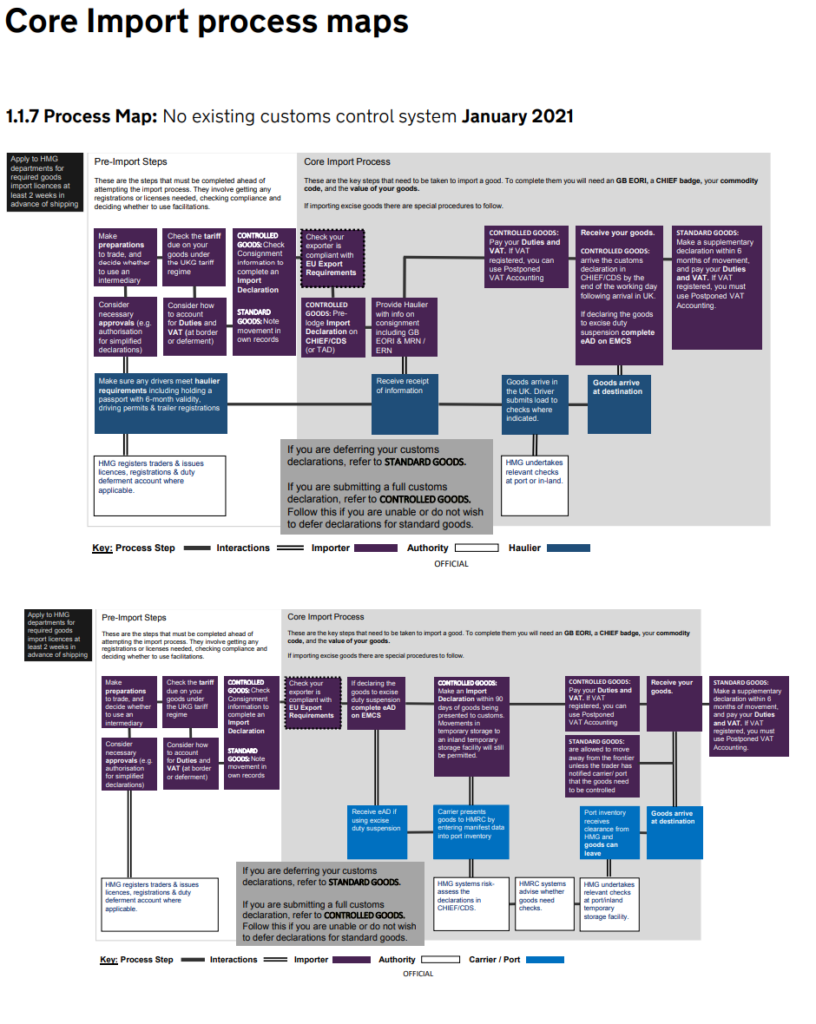

Relative for ADS sectors, BOM V.2 also contains refreshed process maps to reflect more detail on goods movements, these are included as PDFs in this blog. It also contains a number of new annexes relating to passengers’ policies, requirements for aviation, rail and energy sectors and requirement on Member States.

What’s Missing?

The model does not cover anything to do with Northern Ireland or the Protocol. However, ADS does continue to monitor progress on anything to do with the Northern Ireland Protocol, and all the Brexit developments as more details emerge. We continue to update our Brexit Hub with relevant information and support members through our Brexit Preparedness Webinar Series.

The next webinar in our series is on the Border Operating Model with speakers from across Government including the Border Protocol Delivery Group (BPDG), HMRC and BEIS. Members can register for the event now through the ADS website.